What can we help you with today?

Report a Lost or Stolen Debit Card

To report a lost or stolen debit card call

833-999-1105.

24 Hours 7 Days a week

Home Mortgage

Get the exact home loan to meet your specific needs. We’ll guide you through the entire process.

Calculate your FDIC Insurance Coverage

EDIE the estimator can help you calculate the amount of coverage on your deposit accounts.

Check out some of our most popular products and services.

Mobile Wallet

We are excited to offer Apple Pay®, Samsung Pay™, and Android Pay™. This mobile technology lets you store your card information right in your smartphone or other device's mobile wallet. Adding this convenience allows you to pay without sharing your card information with the merchant, keeping it secure.

Send money from your account to theirs with Zelle®

Fast. Safe. And free¹ in our Bank7 app.

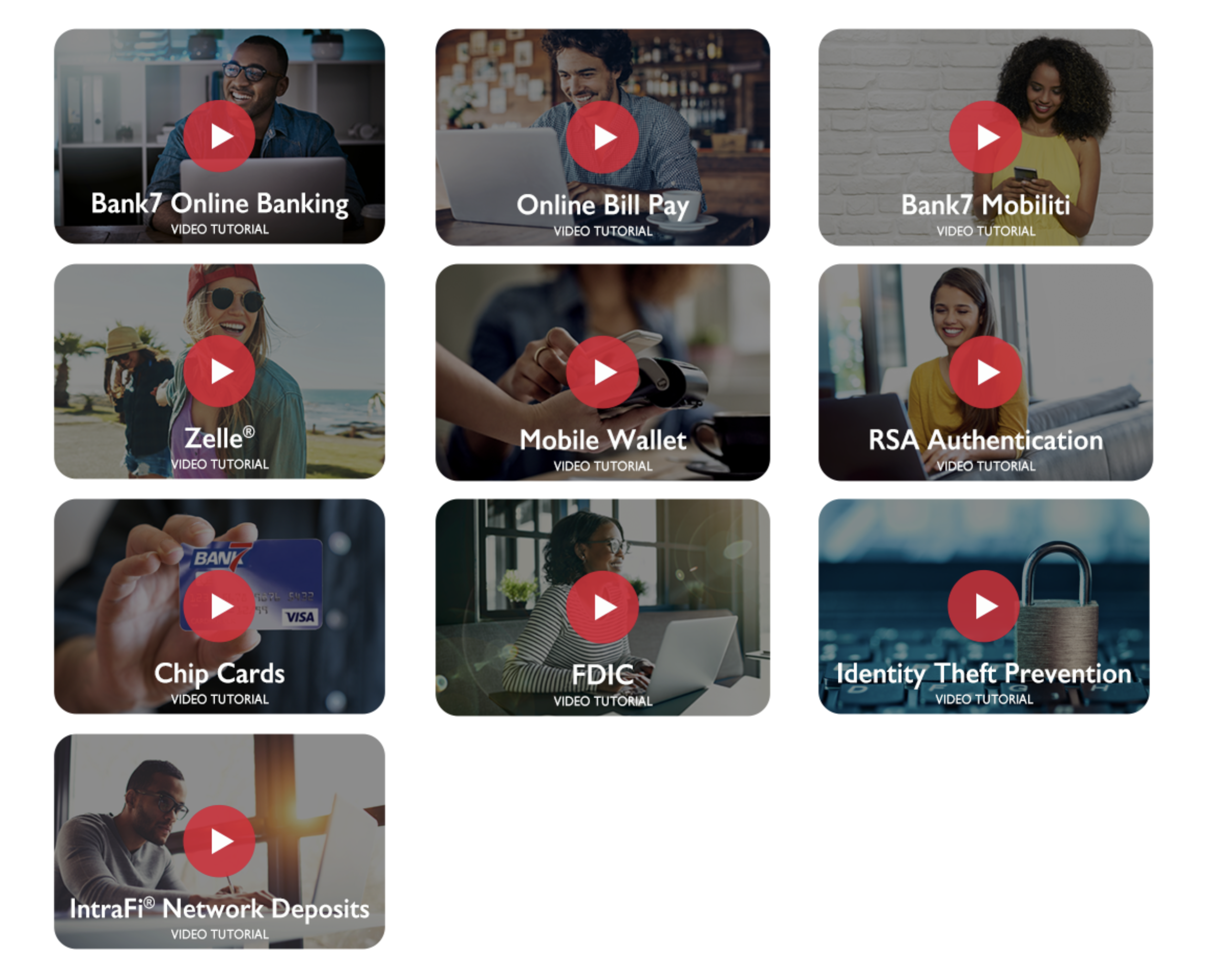

Bank7 Online Education Center

View online banking demos, learn about how to prevent identity theft, get details on Intrafi®, and much more.

¹Must have a bank account in the U.S. to use Zelle®. Transfer amounts and frequency limits apply.